can you go to prison for not filing taxes

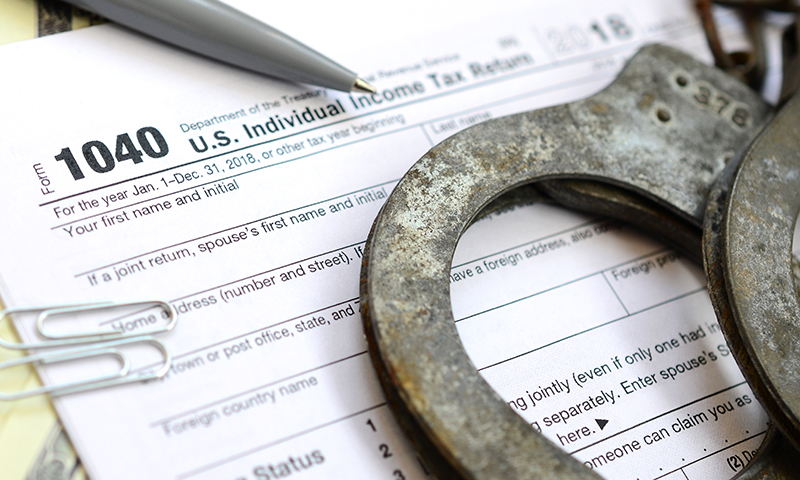

You can go to jail for not filing your taxes. However you can face jail time if you commit tax evasion or fraud.

Income Taxes Filing Procedures For City State Federal

You could also go to jail if.

. Incarcerated people like anyone else have to file a tax return if they have enough income. However you can face jail time if you commit tax. These include if you simply fail to file your taxes because you forgot or were late filing.

Beware this can happen to you. However you cannot go to jail just for owing taxes. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5 years.

You will however incur a minimum penalty of 435 if your return is more than 60 days overdue. Just because you arent filing a tax return that doesnt mean the person who is paying you isnt. The short answer is.

The United States doesnt just throw people into jail because they cant afford to pay their taxes. And you can get one year in prison for each year you dont file a return. So lets take a deeper look at this.

Ohio tax laws Chapter 574715 of the revised code are comprehensive with legal language and penalties to cover practically any occurrence. It is true that you can go to jail for not paying your taxes just as you can for filing a fraudulent tax return. So there are a number of situations where you could face jail time if you fail to file your taxes.

Is It Possible to Face Jail Time for Unpaid or Unfiled Taxes. According to the IRS however this penalty wont exceed 25 of your unpaid taxes. Failure to File a Return.

For most tax evasion violations the government has a time limit to file criminal charges against you. Ad Avoid penalties and interest by getting your taxes forgiven today. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen.

You may even face wage garnishment or property seizure. You can only go to jail for not filing tax fraud or for purposefully evading taxes. Most incarcerated people have in-prison jobs that pay a very small amount of and sometimes no money.

This may have you wondering can you go to jail for not paying taxes. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Oftentimes youll be subject to tax penalties which will run you a pretty penny at up to 50 of your unpaid tax amount.

It is possible that you could go to jail for failing to file your taxes but it will depend on your own personal circumstances. Whether a person would actually go to jail for not paying their taxes depends upon all the details of their individual tax circumstances. Failing to file a return can land you in jail for one year for each year you didnt file.

The following actions can land you in jail for one to five years. The statute of limitations for the IRS to file charges expires three years from the due date of the return. The short answer is maybe it depends on why youre not paying your taxes.

The short answer to the question of whether you can go to jail for not paying taxes is yes. Another way to find yourself in prison for not paying taxes is to not file a tax return at all. Yes but only in very specific situations.

If you are making money that you are not paying taxes on the government will find out. Under the Internal Revenue Code 7201 any willful attempt to evade taxes can be punished by up to 5 years in prison and 250000 in fines. You can also incur the IRSs failure-to-pay penalty which is calculated as 05 of your unpaid balance each month also up to 25 of your unpaid tax bill.

As reported by the Department Of Justice in a press release from 2009 through 2016 Daryl Brown received taxable income but did not file tax returns reporting his income or. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Sometimes people make errors on their tax returns or are negligent in filing but they are not intentionally trying to avoid paying taxes.

A lot of people want to know if you can really go to jail for not paying your taxes. If you dont file a tax return loans are much more difficult to obtain. A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve 57 months in jail.

Most facilities pay you by putting credit in your commissary account. Any action you take to evade an assessment of tax can get one to five years in prison. If you cannot afford to pay your taxes the IRS will not send you to jail.

It depends on the situation.

Civil And Criminal Penalties For Failing To File Tax Returns

Government You Owe Us Money It S Called Taxes Me How Much Do I Owe Gov T You Have To Figure That Out Me Ijust Pay What I Want Gov T Oh No We Know

The 2022 Tax Deadlines In 2022 Tax Deadline Tax Filing Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

Irs Warns Of Higher Penalties On Tax Returns Filed After September 14 The Irs Warns Taxpayers Who Have Not Yet Variable Life Insurance Tax Attorney Irs Taxes

Can I File My Boyfriend S Taxes If He Is In Jail

10 Common Tax Mistakes That Cost You Money Infographic Tax Mistakes Income Tax Income Tax Return

22 Taxing Quotes On The Good Bad And Evil Of Federal Income Tax

Who Goes To Prison For Tax Evasion H R Block

Understanding Your Own Tax Return Income Tax Return Irs Tax Forms Income Tax

What To Do If You Did Not File Taxes How To Avoid Major Penalties

Can You Go To Jail For Not Paying Taxes

Unfiled Tax Return El Paso Tx Villegas Law Cpa Firm

Preparing Tax Returns For Inmates The Cpa Journal

Non Filing Of Income Tax Returns Despite Earning Taxable Salary